According to the VA Department, SGLI ends when you leave the military, unless you qualify for a disability extension. Although you’ll no longer have your SGLI, there are two ways to continue your $400,000 coverage. If done within a certain timeframe, you can continue coverage without having to prove good health (part of the insurance underwriting process). You can convert to either:

- Veteran’s Group Life Insurance (VGLI): Must be done within 240 days of discharge.

- A permanent commercial life insurance policy, such as whole life insurance. Must be done within 120 days of discharge.

These two options are codified in U.S. law and are in place to allow any servicemember to continue this coverage permanently.

Two Questions

This article will outline the difference between the two insurance options and discuss why VGLI might be the better option. But first, we need to answer two questions.

Question 1: Am I limited to only two options?

For the purposes of this article, yes. While term insurance might be less expensive than whole life, it does require medical underwriting.

So let’s assume this article focuses on people who might have a difficult time obtaining a term life insurance policy, due to age, health, disability, or lifestyle. All of which can significantly impact one’s ability to obtain a term life insurance policy in the first place.

If that’s the case, then we’re limited to the two types of policy conversions allowed under U.S. law.

Personally, I’m a fan of term insurance… if you can get a term policy, you should look into it to see if it makes sense for your situation.

Question 2: What is the purpose of life insurance?

Life insurance plays one primary role—to pay a predetermined amount of money to a beneficiary when the insured person dies. If anyone tells you that life insurance also serves as a sound way to invest your money, you should ask:

“How much is the difference between your first-year commission for a term policy and a whole life policy for the same amount?”

The answer might surprise you. Life insurance agents get paid in two ways: first year commissions and trailing commissions. Generally speaking, a life insurance agent’s first-year commission is roughly the cost of the first year’s premiums. If you look at the difference between a term policy’s premiums and those of a whole life policy, it’s easy to see where the incentives lie.

VGLI looks so expensive, especially as you get older.

VGLI does look expensive when compared to SGLI. That’s because SGLI is so cheap compared to any other life insurance available in the world. The first thing you should do when looking for post-military life insurance is disabuse yourself of the notion that you’re looking for something that’s as cheap as SGLI. It’s not going to happen, and it will never be remotely close.

As far as comparing VGLI to a commercial policy—I’m not going to lay out every single scenario. When it comes to whole life insurance, your VGLI will probably be cheaper than a whole life policy for quite a while. The premiums do go up a lot, especially as you reach your 60s or 70s.

This is where you need to determine how long you need life insurance…if you’re retired & financially independent, you might not need life insurance to replace your income after a certain point.

My Personal Experience

I can’t state the case for everyone, but I’ll use the information that I found when I was shopping for insurance policies. A whole life policy didn’t interest me. However, I wanted to shop prices just to make sure. I decided to use the whole life insurance estimator for one of the participating life insurance companies recommended by the VA Department. At my age (age 41) and health, a $400,000 whole life policy would cost about $500 per month. That comes out to $1.25 per month per $1,000 in coverage.

In comparison, I got a 30-year term, $1.5 million policy for about $2,200 per year, or less than $200 per month. This amounts to about 12.2 cents per month per $1,000 in coverage. Dollar for dollar, I was able to obtain coverage under a term life policy for less than 10% of the cost of a whole life policy.

To put it into perspective, if I used the whole life quote, $1.5 million would cost me $1,875 per month, or $22,500 per year.

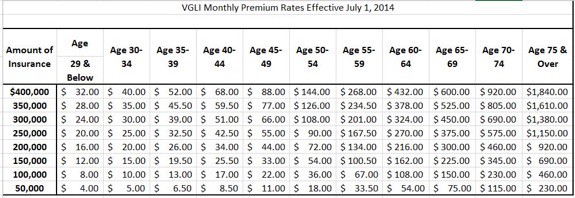

VGLI is probably going to be somewhere in between for most people. As you can see below, a 41 year old would pay $68.00 per month. This amounts to 17 cents per month per $1,000 in coverage.

Image may be NSFW.

Clik here to view.

This amount is 40% more than a term policy, but still 14% of the cost of a whole life policy. Even if I were 60, I would still pay less for VGLI coverage than I would for the whole life policy.

As you age, though, this premium does go up. For a 50 year old, this premium becomes $144, or 36 cents per month per $1,000. By the time you reach 60, this premium becomes $1.08 per month per $1,000. If you happen to need VGLI into your 70s, the premium is $2.30 per month per $1,000.

If you feel like you need insurance into your 70s & 80s, you might consider a whole life policy. But you should really think about that early on. Most likely, if you play your cards and are financially independent, you probably won’t need life insurance that late in life.

How do I make the right decision?

Figure out your insurance strategy up front. Do your due diligence and figure out if you can qualify for a term policy. If you can, secure it before you even think about filing a VA disability claim.

Figure out how long you need insurance. If you plan to retire in your 60s, really think about whether you need a permanent policy. Odds are, you probably don’t.

If you’re leaning towards whole life, you should REALLY think about what you’re getting into. It’s expensive up front, and you might find that you’d rather put your money elsewhere.

Conclusion

Making the right decision can be difficult, and for professional advice, you might want to hire a fee-only financial planner who can help you figure out your financial situation so you can make the decision that’s right for you. When you’re talking to a fee-only planner, you can rest assured that the planner’s compensation is unbiased and in YOUR best interest.